Wednesday, 4 May 2011

Silver's Price Moves Are Affecting Investor Behavior

Silver’s quick and dramatic price shifts now are affecting investor attitudes. Poring through the many silver articles reveals a widespread investment strategy: Buy silver to protect against (profit from) U.S. inflation and a collapsing dollar.

Many are comfortable with that rationale alone. They believe that current U.S. government and Federal Reserve policies mean an inescapable decline (demise) of the U.S. currency. Others apply additional fundamental analysis, such as production shortfall implications and “undervaluation” based on a historic gold:silver price ratio.

Is the strategy a good one?

In investing, the answer depends on two components: The wisdom of the rationale and the price of the investment. In today’s market, the price is the rub. Silver has risen significantly more than the highest U.S. inflation numbers and the U.S. dollar’s decline against the strongest currencies.

Therefore, the developing belief is that silver prices are being driven more by speculation than valuation. (A good article combining a criticism of the Fed’s easy money policy with a warning about silver is in this week’sBarron’s: “Ben Lays an Egg.”)

But isn’t the prospect of higher demand the key?

Yes. However, demand is driven by different factors, depending on the investment’s phase. Let’s look at the three phases silver has been through over the past months, beginning with the normal demand/supply situation.

[Click all to enlarge]

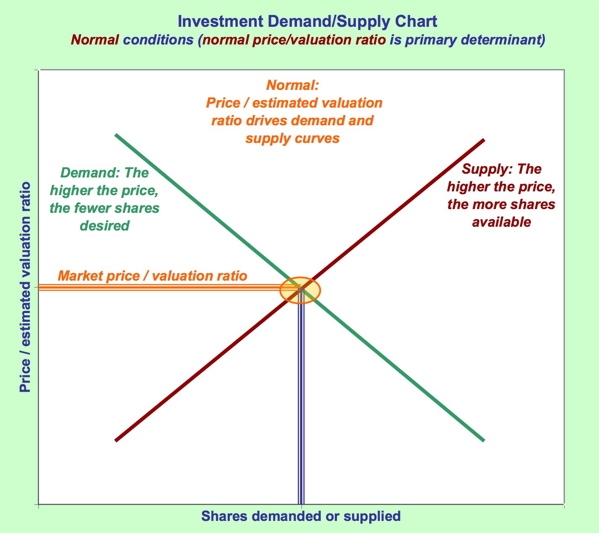

In investing, demand and supply usually is based on valuation (price relative to estimated worth). Therefore, a higher price deters demand and encourages supply, while a lower price has the opposite effect.

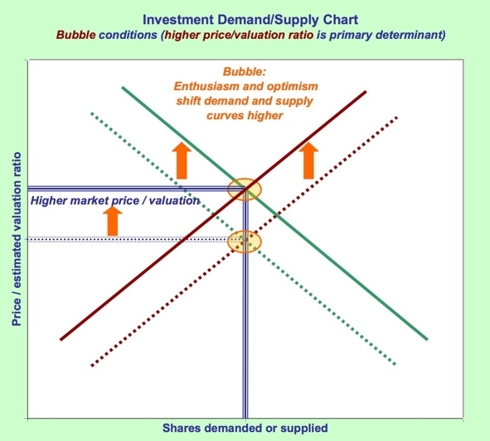

Next, let’s examine what happens in a bubble environment.

Here, enthusiasm and optimism drive prices up by raising valuations.

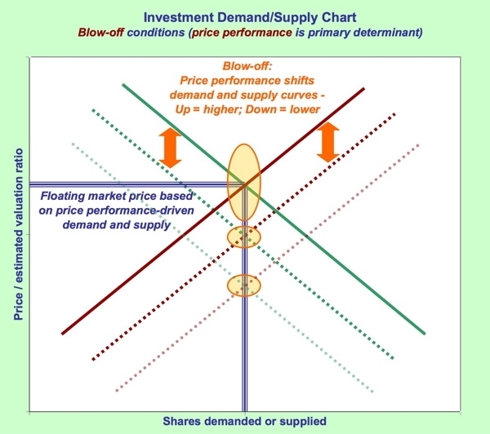

Finally, a bubble can morph into a blow-off.

Rising prices themselves entice investors, thereby raising the demand and supply curves. This situation can produce a seemingly perpetual moneymaking machine: Price rise = increased demand + reduced supply = price rise. This phase has large gains and upward gaps at unsustainable rates of increase. Therefore, it is typically short-lived.

An ugly end

Blow-off endings are dismal. The moneymaking machine can quickly lose its price-rise driver, putting the machine in reverse: Price drop = reduced demand + increased supply = price drop. With fundamental support well below the price, the declines can be large and fast.

Spotting a reversal before it happens is very difficult. It’s dependent on a confluence of widely diversified beliefs, attitudes and situations.

So what about silver today? Will it rise again? Or is this week’s decline a sign of the turn? We will only know that answer in hindsight. The key point is that in a blow-off stage, fundamentals don’t matter – the direction of the price is everything.

Many are studying price charts to identify support levels. That might work, but silver’s rise was so rapid, it spent little time anywhere along the way. Here is the price chart of iShares Silver Trust (SLV):

Another approach is to watch the percentage decline from last week’s high. Currently SLV is off about 17% (from about $48 to $40). A growth stock can suffer a drop of 15-20% and maintain its uptrend. However, a stock in a blow-off period may or may not recover. It’s all about holders’ and potential buyers’ view of the drop – whether it’s an opportunistic dip or a scary warning.

A final chart reading is trading volume. SLV has had significant volume around last week’s top and during this week’s decline. That pattern is more associated with liquidation than capturing an opportunity.

Now is a good time to remember the observation of successful investors: “I made money by selling too soon.”

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

(Source: http://seekingalpha.com/article/267588-silver-s-price-moves-are-affecting-investor-behavior)

This post was written by: HaMienHoang (admin)

Click on PayPal buttons below to donate money to HaMienHoang:

Follow HaMienHoang on Twitter

0 Responses to “Silver's Price Moves Are Affecting Investor Behavior”

Post a Comment